You can sign-up for a Trade Ideas package within our client onboarding portal when onboarding as a new client. Trade Ideas is only available with our CPro trading platform bundle. Existing clients can add the Trade Ideas package to their CPro account by completing the form on our Trade Ideas Bundle page.

You can find Trade Ideas resources including training videos and classes in the Support and Education section of the Trade Ideas website. During market hours, the live support chat is accessible. To open a support ticket, email info@trade-ideas.com. This email address enters the request into the Trade Ideas helpdesk software where it is routed to one of their team members for prompt assistance.

To get a CPro account, you can log in to your secure client portal to submit an ADD PLATFORM request.

Alternatively, you can send an email to your Account Manager or sales@cmelitegroup.co.uk for assistance.

To access a CPro account, you can log in to your secure client portal to submit an ADD PLATFORM request. Please note that you would be subject to a Compliance suitability review to be approved for a Leverage account.

Alternatively, you can send an email to your Account Manager or sales@cmelitegroup.co.uk for assistance.

A platform switch request can be submitted to change platforms from your current Active account to CPro. Log in to your secure client portal to submit a SWITCH PLATFORM request. There is no platform switch fee for this type of request.

Alternatively, you can send an email to your Account Manager or sales@cmelitegroup.co.uk for assistance.

The CPro platform can be installed on a PC or MAC or accessed via web login. Visit the platform page to access these options.

CPro is enabled with Level 2 market depth by default.

Please contact your Account Manager or email clientservices@cmelitegroup.co.uk who will be able to assist you further.

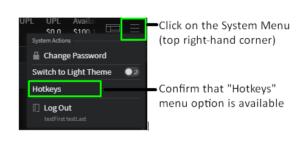

Once logged into your account, follow these steps to confirm:

Joint accounts are not available on CAP it ALL

The time frame for a trade settlement is 1 day following the trade date.

You can short Stocks on a Leveraged CAP it ALL account (providing your funds are above $100.00) however, you cannot short stocks on a Non-Leveraged CAP it ALL Account.

CAP it ALL is currently available on the web, desktop and mobile phone platforms. Visit the CAP it ALL platform page to access these options.

CAP it ALL is enabled with Level 1 market data.

Please contact your Account Manager or email clientservices@cmelitegroup.co.uk who will be able to assist you further.

Available leverage is based on your account balance at the start of the trading day:

During pre-market and normal market hours (4:00AM EST – 4:00PM EST):

Standard Leverage Accounts (CAP it ALL)

Active Accounts (CPro)

Active Accounts (DAS & Sterling)

During extended market hours (4:00PM EST – 8:00PM EST):

Standard Leverage Accounts (CAP it ALL)

Active Accounts (CPro)

Active Accounts (DAS & Sterling)

Yes, pre-market trading begins at 4:00AM EST and post-market trading ends at 8:00PM EST.

Our Active accounts are enabled with Level 2 market data by default and is included in the market depth fee.

To trade during the pre/post market, ensure that you’re placing limit orders only. Market Orders may not be available during these times.

No, we do not offer trading of fractional shares.

At Capital Markets Elite Group we understand that every Trader is unique, diverse and requires different things therefore we offer the following Account types:

For the trading of Equities and ETF’s

Note. that on Fridays-only, after hours trading may only extend from 4 pm to 5 pm EST depending on platform vendor.

Extended Hours Disclosures:

You should consider the following points before engaging in extended hours trading. “Extended hours trading” means trading outside of “regular trading hours.” “Regular trading hours” generally means the time between 9:30 a.m. and 4:00 p.m. Eastern Standard Time.

You can request this by speaking to your Account Manager or emailing clientservices@cmelitegroup.co.uk

If closure of the account happened within six months of it being opened, you can submit your request to your Account Manager or contact clientservices@cmelitegroup.co.uk.

You will be advised by email when the account is reopened. You can then proceed to fund the account.

If the closure of the account occurred more than six months after opening, you will be required to resubmit an account application.

You can request to have your account suspended. Suspended accounts do not have access to the platform and do not incur software and market data fees. Please submit a request via your Account Manager or email for account suspension to clientservices@cmelitegroup.co.uk.

Please contact your Account Manager or email clientservices@cmelitegroup.co.uk who will be able to assist you further.

A margin warning is a warning sent by your broker when a trader exceeds their overnight buying power.

If you receive a margin warning for your Active Account (DAS or Sterling Trader Pro), you will need to rectify this by closing out some of your open positions before 3:30 PM EST.

Failure to do this will result in your positions being liquidated to bring your account back within margin limits.

If you receive a margin warning for your Standard Plus Account (Cap It All), you will need to rectify this by closing out some of your open positions or depositing funds within three (3) business days.

Failure to do this will result in your positions being liquidated to bring your account back within margin limits.

For urgent trade requests:

Capital Markets Elite Group does not share in clients’ profits or losses that maybe due to the software provided by third-party suppliers.

We can accept the transfer of securities and funds to us from third-party brokerages. If you’re interested in this method as a way of account funding, please reach out to our customer services team .

Yes, however a short position being held overnight cannot exceed 10% of an account’s value.

e.g : If an account has $20,000 in equity, the account can hold a maximum value of $2000 for each/any individual short position(s

Email your Account Manager or the sales desk with your account number and clear instructions of the specific trade execution required.

As this may incur a cost per trade. Please check with us first.

The Account Manager is an area within your secure client portal where you can view your trading account reports and download the PDF forms associated with your trading account.

When logging in to the Account Manager, you must use the password that was sent to you in the Account Approval email. If you do not know what this password is, you can use the “Forgot my Password” link to reset the password for this platform.

In the report section of the Account Manager portal, you can run various trade performance reports.

You can view your balances and deposits in the Report section of the Account Management Portal- in the Adjustment Report. This report shows all cash movements within your account.

The reports available in the Report section of the Account Management Portal can be used as a statement of activity. Clients can also request official statements by sending an email request to clientservices@cmelitegroup.co.uk.

All prices/fees displayed on this website are in US Dollars regardless of the currency you use to fund your account.

As soon as your funds have been received and your platform password and log in details have been sent to you, the full market data fee is applicable for that month.

These fees are not pro-rata and cannot be waived.

If you have funded your account and do not plan to use it until the following month, please tell your Account Manager or contact our Client Services Team in order to postpone your activation until the following month to avoid you being billed unnecessarily.

Please visit our Pricing page to see the fees charged.

The following interest rates are applied based on the market value of long / short positions at market close:

Das Trader Pro – Long / Short position overnight fee

7.5% APR – $0 to $100k

6.5% APR – $100,000.01 to $1,000,000

5.0% APR – $1,000,000.01 to $3,000,000

4.5% APR – $3,000,000.01 and over

Sterling Trader Pro – Long / Short position overnight fee

7.5% APR – $0 to $100k

6.5% APR – $100,000.01 to $1,000,000

5.0% APR – $1,000,000.01 to $3,000,000

4.5% APR – $3,000,000.01 and over

CAP it ALL – Long / short position overnight fee

6.25% APR – Applicable for Standard Plus accounts only.

Please remember these percentages are on the borrowed (leveraged) amount not your capital.

There is no fee charged for margin calls however, we recommend that you keep your account sufficiently funded to avoid being margin called.

If you have any issues with funding the account or your trading please contact your Account Manager or our Client Services Team.

Yes, your leverage will be removed if your account balance falls below the following amounts:

Deposits

When trading the US Equity markets via the CAP it ALL, Sterling Trader Pro and DAS Trader Pro platforms, your Trading Account will be denominated in USD Currency. When funding your account, the following fees apply:

Bank Transfers:

GBP/EUR currency deposits are inclusive of a 1% FX conversion fee.

USD currency deposits have no FX fee.

Withdrawals:

At the point of withdrawal, your USD Trading Account balance will incur the same 1% FX conversion fee when remitting funds to GBP / EUR denominated Bank Accounts. For outgoing wire transfers, there is no charge for Domestic Wires (i.e., wires within the UK). However, for International Wires (i.e., wires outside the UK), a processing fee of US$60 will be applied to each withdrawal.

To fund your account, simply login to your Client Portal.

Here you’ll find the bank transfer instructions to fund via bank transfer.

Please note that if you’re funding by bank transfer, you’ll need to use your online banking / telephone banking / or authorise the transaction in branch.

If you have any issues, please contact your Account Manager or our Client Services Team.

You can fund your account using GBP, EUR or USD.

If you choose not to send USD, please note that we will convert your funds into USD for trading purposes*.

*This applies only for CAP it ALL, CPro, DAS Trader Pro and Sterling Trader Pro accounts.

The minimum funding is variable on each Trading Platform we offer due to any software and market data fees we charge.

We only accept deposits from a singular account registered in your name. We do not accept third-party bank transfers or card payments.

Your money goes directly into your trading account that we at Capital Markets Elite Group (UK) Limited hold for you, with your account number.

While wire transfers can go directly from your bank to ours, in some instances banks will use an intermediary bank. Please confirm with your bank what is required before initiating a wire transfer.

Once funds are received, they’re credited to your Trading Account.

Please note that GBP transfers are normally received within the same working day, EUR & USD transfers can take up to two (2) business days.

If you have any queries, you can send a copy of your wire transfer confirmation or receipt to your Account Manager who will inform you once it has arrived or alternatively you can send it to our Client Services Team.

If you’ve made a mistake when entering our details when making a bank transfer, this may result in a delayed or even rejected transaction.

You can call or email your Account manager alternatively you can call +44 (0203) 854 0041 or email our Client Services Team.

When trading US equities you are able to withdraw funds from your account after the two (2) business day settlement period for trades and deposits.

For example, if you were to execute an order on Monday, settlement would typically occur Wednesday – after which you can submit your request.

You can send funds from any financial institution or service that can facilitate international wire transfers in USD, GBP or EUR.

We strongly recommend you reach out to your financial institution directly and verify that they will be able to facilitate this transaction.

Your Account Manager or our Client Services Team can assist you with making a broker-to-broker transfer.

We offer Demo Trading Accounts for the CAP it ALL and CPro platforms.

We offer the free demo accounts for a duration of fourteen (14) days.

Please check your junk and spam folders, in case the email was redirected there.

If it’s not in your junk or spam folder then please resubmit your request and make sure your email address is spelled correctly.

Please contact our Client Services Team or your Account Manager with your userID and we will have the password reset done for you. You will receive an email with a new password.

If you need to revisit the application before you submit it for review, you can login to resume your session at any point.

To complete your application form for a Trading Account with us, we require you to submit a Proof of Address and Government Issued ID.

Accepted Proof of ID

Accepted proof of Address

Please ensure that all documents are sent in PDF or Clear scan or photo format with all corners of the document visible without any obstruction.

For additional information see our individual account opening guide here.

Yes, Capital Markets Elite Group (UK) Limited accepts non-nationals providing it is not in violation of your jurisdiction’s regulations or UK regulations.

The information on this site is not directed at residents of any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

If you reside in the US and have tax implications there, you cannot trade using Capital Markets Elite Group UK.

Yes, we provide Corporate Accounts for registered businesses and sole traders.

Simply contact our Corporate Account Team via sales@cmelitegroup.co.uk to get started.

Please see Documents for the complete Corporate Account Form (put link in https://www.cmelitegroup.co.uk/forms-documents )

At Capital Market Elite Group we have a variety of platforms for you to use that will capture your unique requirements.

Account Types:

Active – Using CPro, DAS Trader Pro or Sterling Trader Pro Platforms, featuring 1 x 4 Leverage during market hours and 1 x 2 outside standard market hours to day-trade US Equities.

This account type suits those who want to capitalise on the short-medium term price movements and generally exit their positions by the end of each trading day.

Standard – Using our proprietary Cap It ALL platform, featuring non-leverage, to trade US Equities. This Account Type suits the ‘swing-trader’ or ‘long term’ investor.

Standard Plus – Using our proprietary Cap It ALL platform, featuring 1 x 4 Leverage during market hours and 1 x 2 outside standard market hours.

You can send these directly to your Account Managers email and they will forward to the relevant department, alternatively you can send it to sales@cmelitegroup.co.uk along with your full name in the email subject.

Application processing generally takes 1-2 business days providing that the documents submitted meet our requirements.

Upon completion, you’ll receive two emails – containing your logins to your Client Portal and your Trading Platform logins.

If you haven’t received your login details within 1-2 business days, please check for any correspondence from us and respond to them as quickly as you can.

Missing details or information from you can cause delays in opening your account.

If you have any questions, our Client Services Team is here to help.

Your username, one-time password and all other relevant account details will be provided in your account approval confirmation notification which will be sent via email. Make sure to retain this email for future reference.

Once you have deposited your funds, you will receive an activation email which will have your platform download links along with your Username and temporary password.

01-101, 51 Eastcheap, London, EC3M 1DT, United Kingdom.

Capital Markets Elite Group (UK) Limited is registered under the laws of England and Wales, company number 07832612, and is authorised and regulated by the Financial Conduct Authority (FCA) under the registration number 583632.

We do not file taxes to HMRC on behalf of our clients. You may need to consult a Tax Agent on how to report any gains or losses on your trading account.

Whilst we don’t report on your tax information, we can provide an account summary statement upon request by sending an email to our client services team or contact your Personal Account Manager.

Additionally, the reports available on your account management portal can be used as a statement of activity.

Security of client funds is our priority. Clients are assigned segregated accounts held with

Barclays Bank London, and feature FSCS protection up to £85,000 for eligible claimants

We understand that taking a break is sometimes necessary.

Therefore, we offer the option to keep your account open but inactive for as long as needed.

If you do decide to close your account, please don’t hesitate to contact your Account Manager or complete the Account Closure form to withdraw any remaining funds before closing the account.

You can initiate this request by sending an email to clientservices@cmelitegroup.co.uk.

Please confirm that you are over 18 years old to continue