Ticker Symbol: BBY

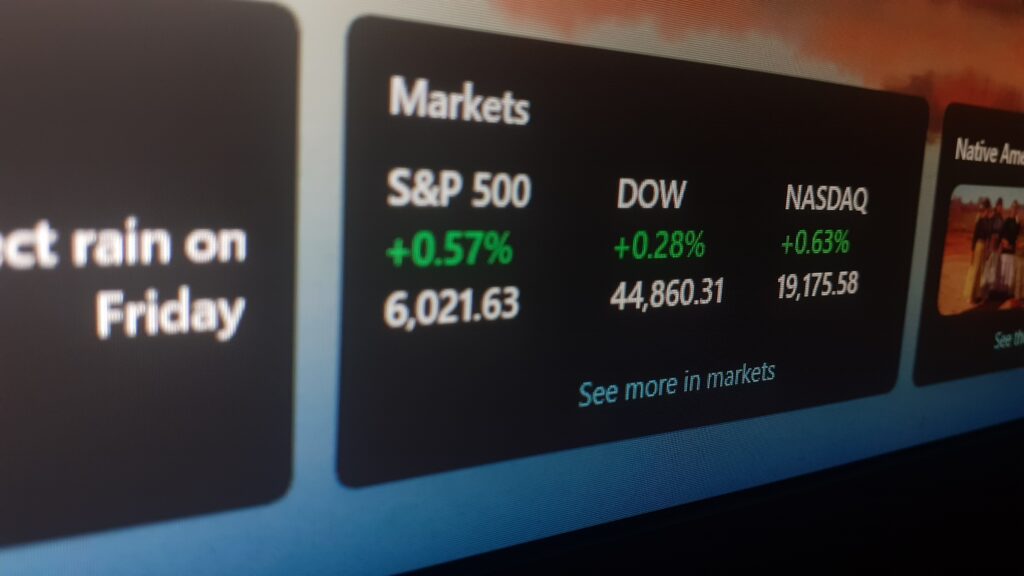

Best Buy Co., the large U.S. retailer of electronic gadgets, and appliances, gained around 5.5% at market open after beating profit estimates for the company’s fiscal second quarter. Earnings per share fell 48.3% year over year to $1.54 which was higher than the average analyst estimate of $1.35. The beat comes after the company lowered expectations in July as management saw waning demand for its products. Best Buy shares are down 22.8% on a year-to-date basis, moderately underperforming the broader S&P 500 which is down just over 15%.

Enterprise-wide comparable sales, a key metric that tracks sales at stores open for at least a year, fell 12.1% during the three-month period, compared to the 19.6% growth in 2021, but better than the 13.1% decline expected by Wall Street. U.S. specific comparable sales were down 12.7%, worse than the 11.3% drop expected by analysts. Entertainment sales were down 9.2%, computing and mobile sales by 16.6%, appliances sales by 1.2% and consumer electronics by 14.7%. Even online sales were down 14.7% year over year.

The company also reported that revenue for the quarter declined by 13% from the same period last year, to $10.33 billion, which was in line with analysts estimates. Management has launched initiatives to pivot the company away from electronics to other areas that are more friendly to physical locations. Over the past twenty years, sales of appliances, electronics and laptops have shifted significantly online. The company is looking to grow its new $200 a year service membership, Totaltech, which gives customers early access to the latest items, discounts, and access to the company’s Geek Squad repair services as well.

Furthermore, Chief Executive Officer Corie Barry said in the earnings call that the retailer is “focused on balancing our near-term response to difficult conditions and managing well what is in our control, while also delivering on our strategic initiatives and what will be important for our long-term growth.” In addition, Best Buy incurred $34 million in restructuring costs as it cuts jobs and costs to deal with the falling demand for discretionary items. During periods of economic upheaval, consumers generally cut spending on large ticket discretionary goods first.

Gross margins slid in the U.S., declining to 22% from 23.7% in the second quarter of last year. Operating margin dropped to 4.1% versus 6.9% last year. The company ran more promotions this year to clear inventory and dealt with supply-chain issues which increased operating costs. Critically, however, the company maintained its fiscal year targets after it lowered them last month. Lastly, Best Buy’s online sales penetration, at 31% of total domestic sales, is almost twice as high as pre-pandemic Q2 FY20.

This content is provided for general information purposes only and is not to be taken as investment advice nor as a recommendation for any security, investment strategy or investment account.