Ticker Symbol: F

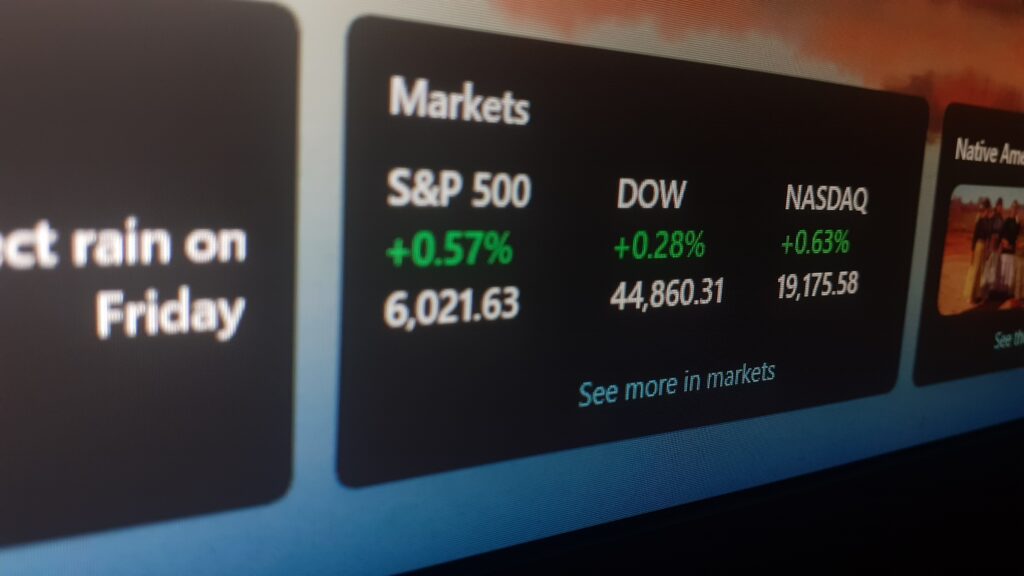

The second largest vehicle manufacturer in the U.S., Ford Motor Company, announced yesterday evening that inflationary costs are going to eat into the company’s current third-quarter profits. Shares are down over 9% in the morning hours, last exchanging hands at $13.55. Ford shares have underperformed the broader S&P 500 index and main competitor GM on a year-to-date basis. Ford shares are down 35.5%, versus the 19.1% decline in the benchmark and the 32.7% decline in General Motors.

The company said that supplier costs are going to be $1 billion higher than previously anticipated. A dearth of availability of parts would also weigh on profitability during the quarter, pushing operating margins lower than the consensus estimates from Wall Street analysts. In Monday’s material filing, management stated that the company would have a shortfall of 40,000 to 45,000 higher-margin trucks and SUVs it had previously scheduled to produce from the July to September end period.

Instead, the auto giant expressed confidence that those trucks and SUVs would and could now be completed by December 31st. Critically, leadership still expects to earn between $11.5 billion and $12. Billion for the full fiscal year, meeting its prior forecast. But for the current quarter, Ford said that the deficit in production, combined with the aforementioned $1 billion in higher-than-expected costs, will result in adjusted earnings before interest and taxes of between $1.4 billion to $1.7 billion.

Analysts were projecting about $2.9 billion in adjusted EBIT before the update. The company earned $ 3 billion in the third quarter of 2021, and $3.7 billion in the second quarter of this fiscal year. Ford’s new forecast, based on the midpoint of the projection, would mean the company’s operating profit is going to be $1.4 billion short of the average analyst expectation. Given that management left the full-year guidance unchanged, the company would have to produce an adjusted EBIT of over $4.5 billion in the last quarter of the year.

Ford could achieve that partly by increasing the price for its vehicles. Further, Ford would have to push the additional 45,000 trucks it didn’t sell in this quarter in the last three months of the year to recognize the revenue and profits from those products. Parts shortages and cost-controls would also have to remain well managed for Ford to be able to hit its desired metrics. Given today’s slide in the share price, however, investors may be assigning a low probability to the likelihood that management could achieve all those targets.

This content is provided for general information purposes only and is not to be taken as investment advice nor as a recommendation for any security, investment strategy or investment account.