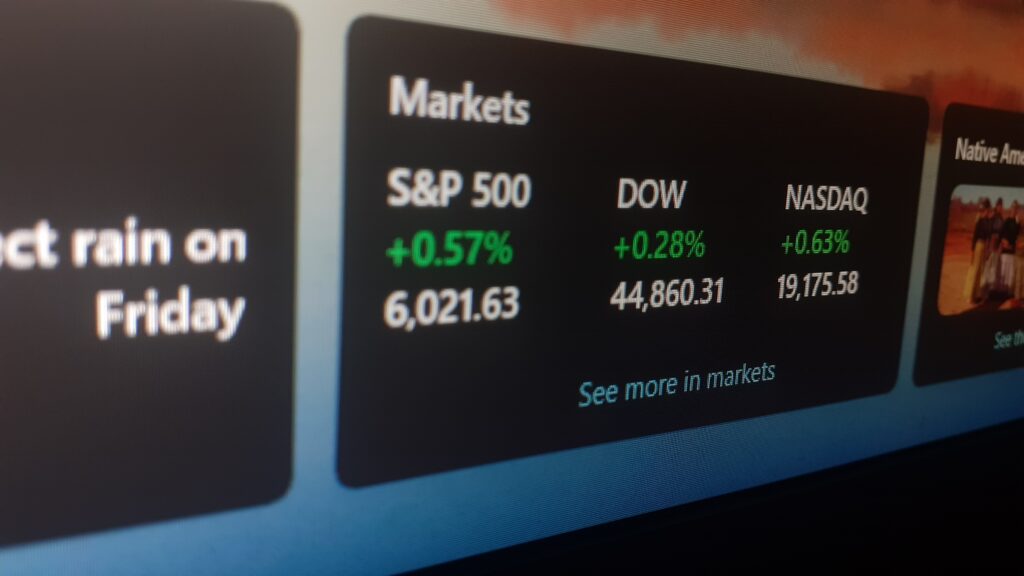

Recently, the S&P 500 posted gains after breaking a losing streak. However, optimism may be fleeting with futures showing little change. Some analysts argue that the market is overdue for a bounce due to rapid declines attracting bargain hunters and potential easing of trade tariffs by the White House.

The recent pullback on tariffs has provided some relief for investors concerned about their economic impact. Additionally, commentary from David Zervos at Jeffries suggests that while immediate effects of policy changes are uncertain, long-term prospects remain positive as shifts toward private sector growth could benefit consumers and businesses alike.

In an ideal scenario where targeted tariffs do not disrupt global trade significantly, consumer confidence might rise alongside job stability—an outcome deemed beneficial according to Zervos’ analysis of Trump’s budget cuts. Similarly optimistic views emerge from technical strategists like Craig Johnson at Piper Sandler who expect continued recovery in equities despite inflation worries.

Today’s favorable sentiment has particularly boosted riskier assets such as technology stocks while reducing volatility indicators like VIX; however, skepticism remains warranted given persistent uncertainties surrounding governmental policies and how they distract from more favorable tax regulations sought by Wall Street post-election.

Many companies have issued profit warnings amid tariff-related fallout without reaping benefits expected during this period of anticipated growth driven by political changes—a situation highlighted by Larry McDonald’s remarks on investor expectations versus reality over recent months leading to stagnant earnings projections despite earlier enthusiasm around high-growth opportunities.

From a broader perspective, outlined by Ari Wald at Oppenheimer Group, the upcoming volatility, contrasted against short-term patterns, indicates mixed signals ahead. Even if indices reclaim previous highs, it suggests that challenges persist for sustained progress in light of existing headwinds within consumer confidence dynamics, which are closely linked to stock performance trends throughout this year. This could jeopardize ongoing economic expansion efforts amidst potential recession signs, looming larger than before, based solely on current data readings. These are subject to swift alterations, reflecting broader systemic issues unfolding rapidly within financial landscapes today. This echoes Lenin’s famous observation about time compression between significant events affecting markets dramatically over relatively brief intervals, compared to historically observed periods lacking notable developments altogether.