Nvidia Corp. relinquished early gains Thursday after a brief post-earnings surge failed to calm mounting concerns that the artificial-intelligence boom is overshooting fundamentals.

Shares fell 1% to $184.65 in afternoon trading, retreating from an intraday high of $196, as broader equity markets also reversed earlier strength. The S&P 500 slipped 0.5%, while semiconductor names broadly weakened. AMD tumbled 4.8%, Broadcom edged up 1%, and the iShares Semiconductor ETF swung to a 2.1% loss.

The pullback followed a tense lead-up to Nvidia’s results. A wave of high-profile investors—including SoftBank Group and a fund tied to Peter Thiel—recently disclosed they had dumped Nvidia shares. Meanwhile, noted short seller Michael Burry renewed warnings about overheating in the AI sector, accusing companies of overstating chip lifespans.

Stronger Results, Higher Forecasts

Nvidia reported adjusted earnings of $1.30 a share for the third quarter, topping the $1.26 average analyst estimate. Revenue soared 62% year over year to $57 billion, beating expectations for $54.9 billion, according to FactSet.

The company projected current-quarter revenue with a midpoint of $65 billion, comfortably above the $62.2 billion consensus. The guidance suggests revenue growth accelerating to about 65%—and notably excludes any contribution from China.

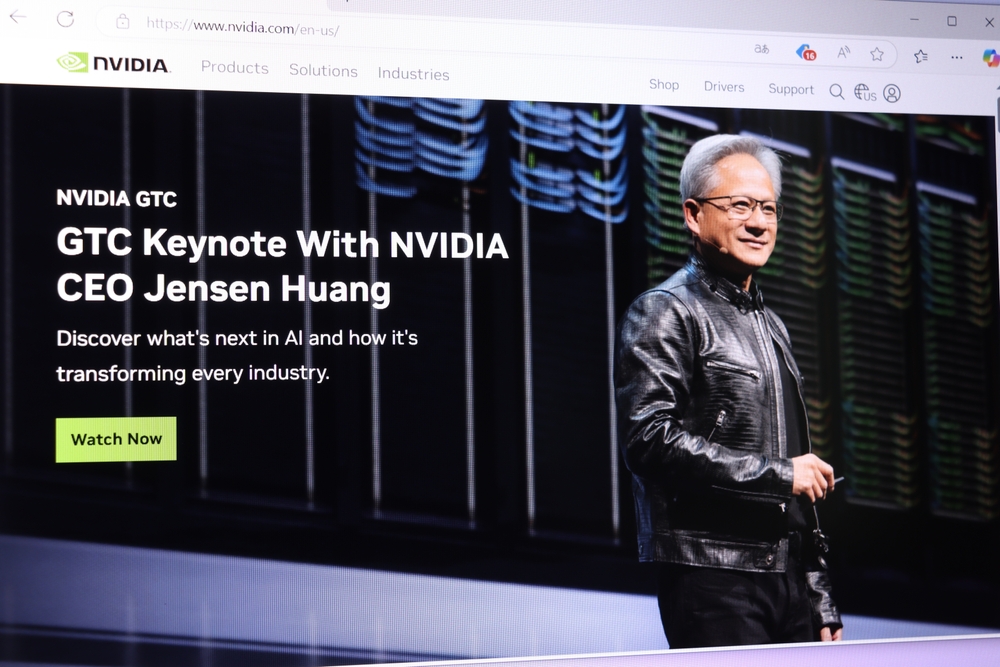

Demand for the company’s Blackwell-generation chips is “off the charts,” Chief Executive Officer Jensen Huang said. Chief Financial Officer Colette Kress added that chips shipped six years ago remain fully utilized by customers, an important signal amid debate over whether AI infrastructure spending is sustainable.

But despite blowout numbers, the report did little to answer Wall Street’s deeper questions: where the money for AI investment is coming from—and whether it will produce returns commensurate with the scale of spending.

“Even NVDA’s upbeat report has not been enough to reverse recent market headwinds,” analysts at 22V Research wrote. Risk-off sentiment has dominated trading in recent weeks, they said, as low-volatility stocks take the lead. That pattern held Thursday, with defensive names outperforming even after a strong showing from Walmart.

Analysts Stay Bullish

Some on the sell side remain optimistic. The new average Wall Street price target is roughly $248, implying about 33% upside from Wednesday’s close.

Ben Reitzes of Melius Research said Nvidia helped counter concerns about aggressive chip-depreciation timelines, suggesting software updates are extending the useful lives of older processors. He lifted his price target to $320 from $300 and maintained a Buy rating.

Gil Luria of D.A. Davidson reiterated a Buy and a $250 target, noting management now expects to exceed the previously stated $500 billion in cumulative revenue potential for Blackwell and next-generation Rubin chips between early 2025 and 2026.

Regulatory Tailwind on Exports

Nvidia also gained a modest regulatory boost. The US Commerce Department approved the sale of as many as 70,000 advanced AI chips to two Gulf-region firms—Abu Dhabi-based G42 and Saudi Arabia’s Humain—The Wall Street Journal reported, citing government officials. The authorization covers as many as 35,000 of Nvidia’s GB300 servers or equivalents for each firm.

While the allocation is limited, the approval signals a potential pathway toward larger AI-chip sales across the Middle East—an increasingly important growth market for US semiconductor makers.