What happened with GameStop?

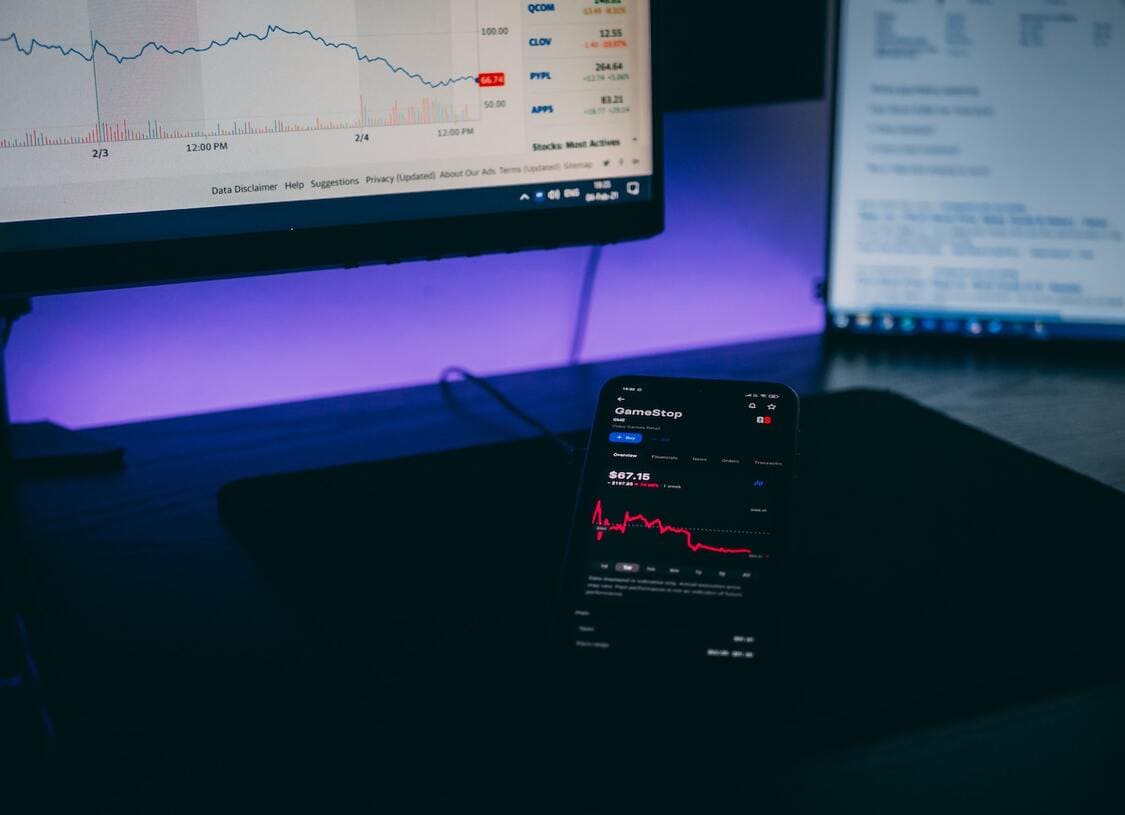

In January 2021 the unthinkable happened. Despite GameStop having been in trouble as a business due to store closures, a Reddit group of everyday traders called WallStreetBets (WSB) drove GameStop’s stock up 1,500-2,400% in a matter of days and put a short squeeze on hedge funds such as Melvin Capital Management who lost 53% of its value in the same month. Despite GameStop having been in trouble as a business due to store closures.

The rise and fall of GameStop, GME, is by no means a story that has come to an end. Price volatility in this symbol is expected to continue for some time, and it comes with a warning to all short sellers (a practice often employed by speculators, hedge funds and experienced professionals).

Here are some very interesting lessons learned from what happened with GameStop.

Lesson one: The new decentralization of market influence

Retail investors and traders can communicate their ideas about investment with each other like never before. Whether it is on Discord, Reddit, Clubhouse, YouTube, or some other social media platforms, there is little stopping individuals from putting forward their views, gaining a significant following and more market momentum than ever before.

Shouting loudly can gain attention – and if millions are listening and following, the influence can be powerful.

There is a clear lesson for all market participants, whether retail or institutional. The influence that was previously reserved for only the powerful and large influential institutional players, has changed. This new force can and will impact markets in the future — decentralized social power as expressed by retail investors and traders on social media platforms.

GameStop is an early example of the exercise of this power. It will not be the last.

If you think Bloomberg and CNBC are the only places for market news, think again.

Lesson two: Fundamentals still matter, or do they?

With the advancement of e-Commerce and downloadable video games, short sellers put massive pressure on the stock price of Gamestop as mainly a “brick and mortar” retailer, and bet against the fundamentals of the company.

What WSB exposed was the knowledge of that short position and short interest and used their masses of retail investors to bid up the stock price, causing a short squeeze. When that happened, GameStop’s price completely separated from its underlying fundamental value for a period of time.

And this isn’t happening only to GME. It’s a trend we’ve increasingly seen happening, notice AMC Entertainment Holdings Inc (AMC), Dillard’s, Inc (DDS), Tanger Factory Outlet Centers Inc. (SKT), Bed Bath & Beyond Inc. (BBBY), etc. These are all companies with concerning fundamental business models (mainly because of Amazon.com, Inc. (AMZN) and a swing towards online purchasing) that were heavily targeted by Wall Street short sellers. Yet, all of them had explosive upward price action in the first quarter of 2021.

Some very experienced investors are worried by the separation of stock value to fundamentals and the impact this has on valuations. Others feel that the two have not related much for some time now. GameStop is a good case in point. While the fundamentals didn’t check out, the stock continued to rise, mainly driven by the passion of traders for price action and their apathy for hedge funds, institutions and their shorting practices.

There is always the threat that brick-and-mortar retailers and stores which sell a product which by and large is available digitally may have a very difficult time convincing markets that they have a compelling long-term business model. Couple this with the impact the pandemic has had through interrupted sales for almost all retail stores, and GameStop’s recent financial data, which showed that its sales were down significantly, it’s not difficult to see what these institutions and short sellers were seeing.

Fundamentally, the value of GameStop is not a stock that had reason to experience volatile soaring highs, until WSB and these new market participants decided otherwise.

Where should GME actually be trading after a shift to true fundamentals? Only time will tell what the future holds for GameStop’s stock price.

At this point in time, these new market players (millennial traders at Robinhood, WeBull, WallStreetBets, etc) may not be quite enough to overcome a stock’s fundamentals and longer-term market traders, but it’s definitely an interesting battle to witness. There are more forces at play when passion and social media come into play.

Lesson three: Are short sellers really villains?

Some in the media and for their own interests have portrayed what happened as a ‘David and Goliath’ battle. With Reddit traders referred to as David and the heroes targeting the short selling practices of the giants and villains: hedge funds and Wall Street institutions. This of course is not the first and will not be the last battle of this nature. While the GME and AMC examples were extreme and unique, short selling squeezes are normal trading conditions and do occur from time to time.

Those who understand how to execute a short squeeze in the future will take stock of what has happened with GameStop. Could we see expert squeezers leverage the power of Reddit and other social media platforms to promote squeezes in the future? Potentially. Watch out for government legislation to protect the big fish and donations from the large institutions, but regardless of that, the game has changed forever.

Capital requirements of brokers, credit risk to the market and protection of investors are all issues that may come under renewed scrutiny. Regulatory changes may have a direct impact on the decisions investors make around group short squeezing in the future and the influence of social media on the markets.

Remember, that the price or valuation of a company is a result of all the buyers and sellers in that stock that creates the current price. Short sellers aren’t villains, just the other side of the coin and a necessary participant in an efficient market. Don’t believe the hype.

What does the future hold?

Social media has changed the market and gives retail traders a place to congregate, collaborate and educate themselves about market definitions such as “short interest”. The upcoming months will be very interesting as the regulatory landscape may evolve as the market structure already has.

One thing is for certain: Retail traders are here to stay and are loudly taking charge.