- Headline inflation declined to 8.5% in July from 9.1% in June, and core inflation remained steady at 5.9%. The readings were better than what economists and market participants had expected.

- This may give the Fed enough space to raise rates by less than the 0.75% hikes that we have seen in the past two meetings.

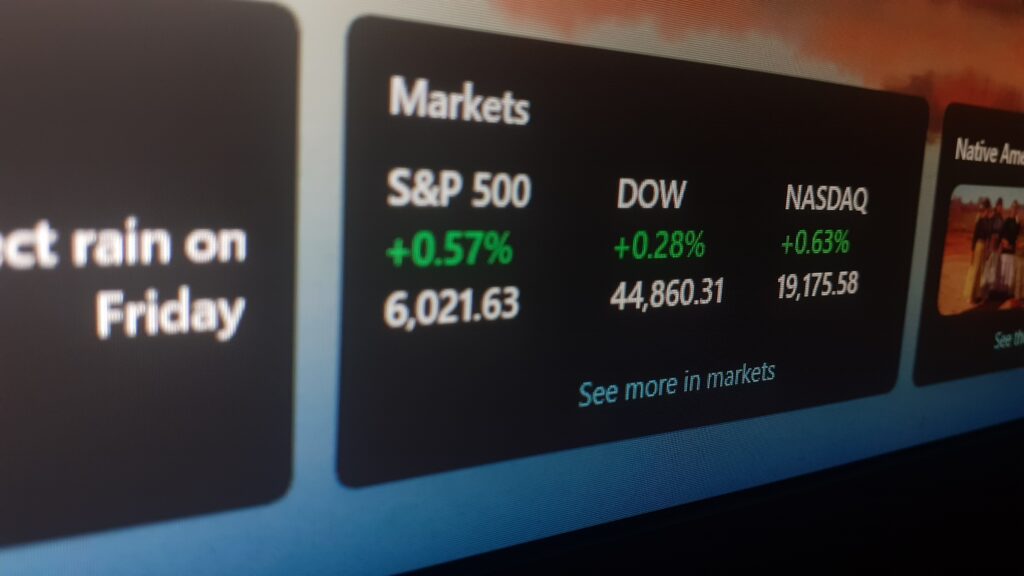

- Equity markets bounced, long-dated bond yields rose, the U.S. dollar weakened, gold gained, and crypto currency prices popped after the report was released. Oil was down slightly.

- Services inflation, and rent prices specifically, continue to remain elevated, while the price of goods declined slightly on a month over month basis.

- The inversion in the yield curve lessened from -50bps to -39bps. An inverted yield curve implies that the market expects a recession in the near future.

Inflation in the United Sates, as measured by the Consumer Price Index (CPI), advanced 8.5% from the year earlier period in July. This was a decline from the 9.1% year-on-year increase reported for June. The number was also below the 8.7% reading expected by economists. As a positive for the Federal Reserve, core inflation, which is the headline number excluding volatile food and energy prices, was likewise better than economists’ estimates, coming in at 5.9% versus the expected 6.1%.

Market reaction to the news was swift with equities rallying after four days of declines, led by the Nasdaq up over 2%, the S&P 500 up 1.8% and the yield on 2-year U.S. Treasury notes dropping by a significant 15 basis points. The dollar also declined sharply, and Bitcoin rallied by more than 4%, touching the $24,000 level. Gold, which has been historically viewed as a hedge against inflation, but has struggled thus far this year, also rose modestly to $1,818 an ounce.

In further good news, oil prices were down by 2.25% for the day and have fallen precipitously in the past two months. West Texas Intermediate, the benchmark oil gauge in North America, was last trading at $88.50 per barrel, down from $122 per barrel in early June. This may mean that the headline inflation for August could be even lower than July’s figure. The average price at the pump for consumers across the U.S. has dropped from a high of $5.02 per gallon in June, to an average of $4.54 per gallon in July, to $4.01 per gallon currently.

Electricity prices, in the meantime, continued to soar for the fifth month in a row, bucking the trend in lower energy prices. The electricity index rose by 15.2% due to a warmer than average summer. Food inflation also remains elevated, thanks in part to the war in Ukraine. While it’s moderated somewhat from the high of 6.5% in March, July’s reading of 5.9% is still going to pressure many lower-income households in the U.S. especially as wage increases have not kept up with the rise in prices. Shelter continues to be a problem as well, with rent prices increasing by 5.95% year over year.

Attention will now, therefore, turn squarely to the U.S. Federal Reserve System and the Federal Open Market Committee (FOMC) to see if the central bank would consider raising rates at 75 basis points or 50 basis points at its next meeting on September 21st. While the market was expecting a 75 basis points move in September before today’s report, the lower-than-expected headline inflation reading has shifted market expectations and futures are now implying a much higher chance of a 50 basis points increase. Lower rate hikes will be seen as supportive of risk-assets such as equities.

This content is provided for general information purposes only and is not to be taken as investment advice nor as a recommendation for any security, investment strategy or investment account.