Ticker Symbol: UBER

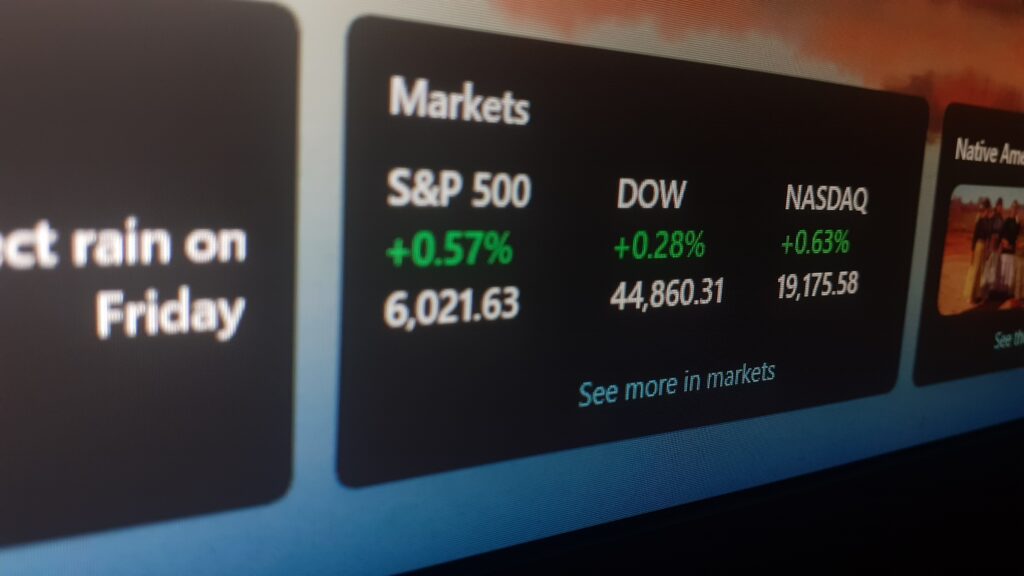

Uber shares are surging, up 14% to $28, after reporting ridership and revenue metrics that handily beat Wall Street forecasts. The company posted second-quarter revenue of $8.1 billion, which was up over 100% year over year, versus the consensus projection of $7.4 billion. Despite the jump in shares in the morning trading session, the company is still underperforming the broader S&P 500 on a year-to-date basis, down 33.5% versus the 14.2% decline in the benchmark.

As the pandemic becomes endemic in much of the world, ride-hailing companies are reporting a surge in ridership as more people return to their pre-pandemic routines. The company posted gross bookings increased by 33% to an all-time high of $29.1 billion for the three months. Delivery bookings made up $13.9 billion of that total, up 7.5% year over year and shy of expectations of $14.5 billion. Mobility gross bookings were $13.4 billion, up 55% over 2021, and well ahead of the expected $12.6 billion.

Freight bookings of $1.84 billion missed estimates of $1.88 billion. Freight is the company’s relatively new third-party shipping business that matches drivers with loads in need of delivery. The company reported positive adjusted earnings before interest, taxes, and depreciation of $364 million, which was better than the loss of $509 million reported in the second quarter of 2021. There were a record 122 million global monthly users of Uber’s platforms, up 21% year over year, and ahead of the expected 120.5 million.

Uber’s Chief Executive Officer Dara Khosrowshahi also noted that new driver sign-ups, a bottleneck for the company during most of the pandemic, were up 76% year over year. An influx of drivers allows the company to complete more bookings and reduce customer wait times, which in turn results in fewer canceled trips. Management said that surge and wait times were near their lowest in a year in multiple markets. Accordingly, Uber reported 1.87 billion trips during the quarter, 24% higher than last year.

The company guided to revenue between $29 and $30 billion for the third quarter, which was short of the $30.2 billion analyst estimates. EBITDA, however, is projected to come in between $440 to $470 million, well ahead of the average analyst estimate of $392 million. Uber has been hit by surging fuel costs across the globe and particularly in the U.S. and Europe. If gasoline prices drop, affordability and demand for the company’s services could increase in the latter part of the year.

Unrealized losses, from equity stakes in other ride-hailing companies such as Grab, Zomato, and Aurora, ended up forcing Uber to report a net loss of $2.6 billion for the quarter. Uber shares are also still trading below the company’s initial public offering price of $45. That would imply a 37.8% decline in the stock price from its IPO date in 2019 versus the 42.7% increase in the large-cap stock index during the same period.

This content is provided for general information purposes only and is not to be taken as investment advice nor as a recommendation for any security, investment strategy or investment account.