The pandemic has had a global economic impact comparable with that of the mid-20th century depression.

The increased fear and uncertainty have prompted a major reduction in household spending and consumption. Coupled with the closure of businesses en masse across a range of sectors it has pushed the global economy into the depths of a recession.

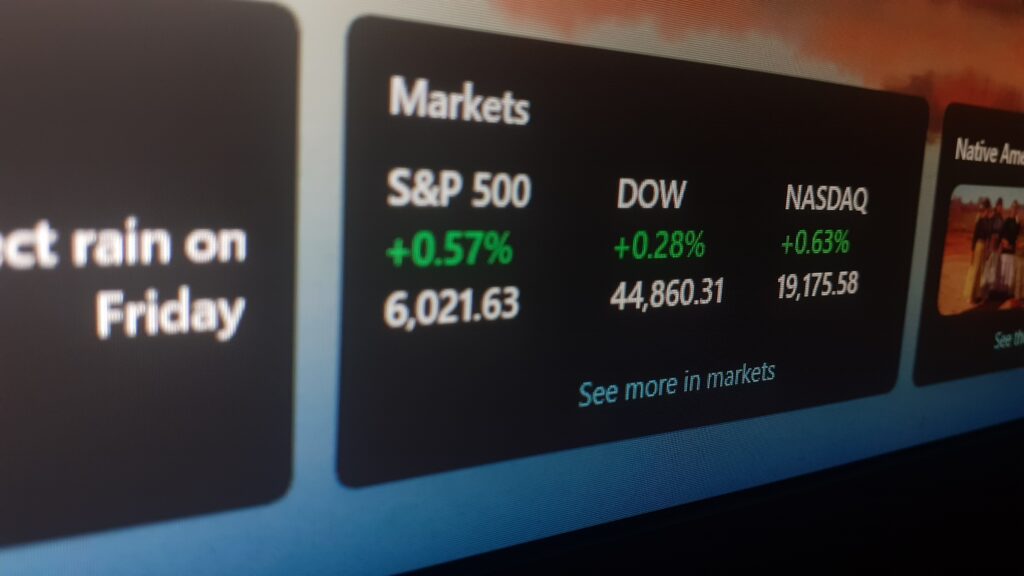

There is no denying the impact Covid-19 has had on international markets. However, the development and rollout of vaccinations have brought a renewed wave of optimism. There has been a sizable rebound in consumer spending which could be the result of pent-up demand and the prospect of a return to normality.

How has the pandemic affected national economies?

The different responses by national governments and the scale of impact upon national economies have meant that different economies have been hit differently as we’ve highlighted in this previous CapitalMEG blog article. Developing countries without the fiscal and monetary support available have undoubtedly taken the biggest toll.

Interestingly, the economic impact to nations such as Sweden and Denmark has been similar, despite their widely different approaches to the lockdown. Some attribute it in large part to most people opting to stay at home and curb their spending despite what the government asked them to do.

The outlook is relatively encouraging for countries that were quick off the mark in the rollout of testing and quarantining of travelers. As a best-in-class example, Taiwan was able to monitor the emerging pandemic with the technologically-supported tracing of expected cases, strict measures early on, and stockpiling of essential medical supplies.

There is also growing optimism about the prospects of economic recovery in countries such as the U.K, U.A.E, and Israel who have led the way in the development and rollout of the vaccines. The UK is hopeful about a ‘one-way road to recovery which began with the reopening of outdoor hospitality, shops, gyms and hairdressers on the 12th of April.

What are the prospects of economic recovery?

Despite progress, there is still some uncertainty about the rate of progress towards pre-covid levels of normality. While there has been a general recovery in rates of production, it may be some time before the world’s consumers regain the confidence to continue their everyday lives outside the shadow of the pandemic.

This would explain why HSBC has warned of continuing caution and permanent damage with unemployment and debt remaining high, up to and beyond the close of 2021. On the other hand, the International Monetary Fund has projected a global economic growth rate of 5.5% in 2021 and 4.2% in 2022.

Economies with a successful rollout of the vaccine and increased policy support in some of the world’s largest economies seem to be able to boost their forecasts.

Other factors and measures that could provide a positive impact :

- The continuation of financial support for businesses affected by the pandemic

- The agreed ending of national lockdowns

- Targeted support for the most severely affected groups (including young people reliant on benefits)

- Investment in areas of economic growth.

The rate of recovery is expected to vary across the world’s economies. China is likely to experience the greatest growth in terms of GDP with an 8% expansion on the cards. Contributing factors include Beijing’s financial stimulus for the recovery of small businesses and households, together with the continued development of urban areas and technologies.

Although the American economy and dollar have been dominant and Biden’s 2-trillion bill now on its way to boost the US economy, the pandemic may well bring about a change in the world order.

There have been significant tensions between China’s increasing prominence during recent years and America’s imposing of international market sanctions in response. There has also been a growth in the size of China’s capital markets.

In any case, a real challenge may only be presented once China’s currency becomes convertible. This process might well be accelerated by the pandemic and the rapid advancement of China’s financial technologies such as announcing a central bank currency called the digital yuan.

How should governments be approaching the economic reopening?

The relatively weak financial position and increased debt will mean that institutional reforms are key to economic growth across many nations. National governments must encourage investment to mitigate the effects of the pandemic and prompt the growth of developing economies.

Financial experts have suggested that support should extend beyond the national schemes that have been rolled out over the past year. There should be a focus on the support of low-income households, with training opportunities being offered to the recently unemployed. Given such support, it is reasonable to expect the growth of the international economy by over 5% through 2021. However, the growth is likely to be buoyed by emerging markets and developed economies with the rapid expansion of the Chinese market being widely anticipated.

A u-curved, or potentially k-shaped, recovery of the global economy seems most likely at present. However, there remains the risk of a double-dip recession or w-curved recovery given the potential of downside risks. There will likely be a marked contrast to the effects of locked-down economies in Q2 of 2020, with a significant rebound in Q2 of 2021.