Ticker Symbol: ZM

Zoom Video Communications, the company whose software became one of the biggest winners from the pandemic and gained “verb status”, reported earnings that beat the average Wall Street expectations last night. More crucially, the company also provided guidance that exceeded analysts estimates, indicating that Zoom may have staying power beyond the pandemic. Shares were up 6.5% in afternoon trading, after being up as much as 22% in aftermarket trading in the previous session.

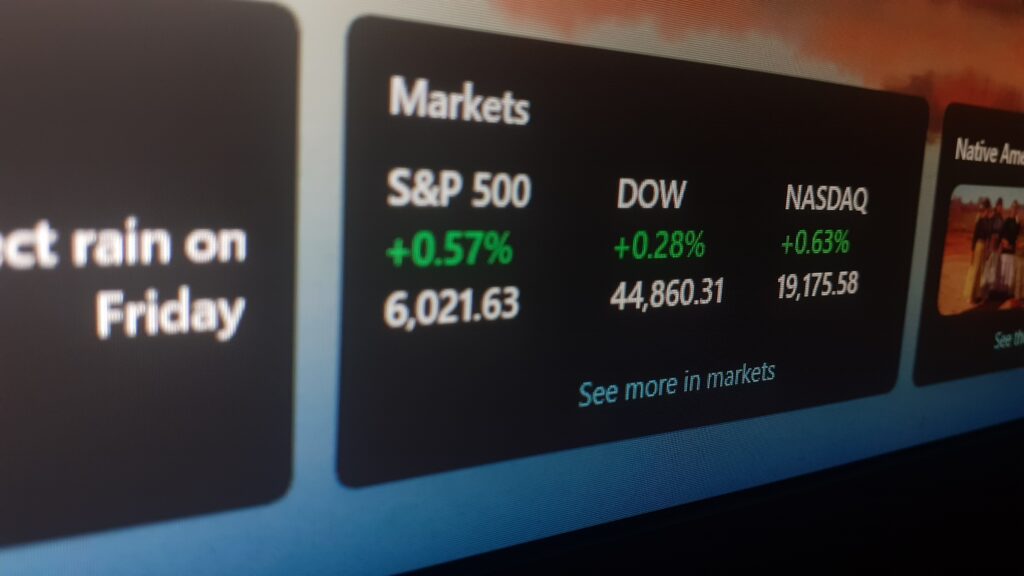

The company reported first quarter adjusted earnings per share of $1.03 trouncing the average analyst estimate of $0.86. Revenue was up 12% year-on-year to $1.07 meeting the $1.07 billion investor estimate. Free cash flow also was a beat, coming in at $501 million against the expectation of $412.7 million. For the second quarter, the company sees revenue of $1.12, ahead of the expected $1.11, while it sees EPS between 90¢ to 92¢, 8% more than the estimate of 84¢. For the full fiscal year, the company sees EPS between $3.7 and $3.77, ahead of the $3.49 expected, and revenue that met guidance of $4.54 billion at the midpoint.

Critically, the company has started shifting focus from the less profitable retail customers to business users who will increasingly represent a larger share of the company’s top line. To this end, Zoom said it had almost 200 thousand enterprise customers as of April 30th. Additionally, the number of customers that contributed more than $100 thousand in the trailing 12 months of revenue was up a whopping 46% year over year. The company also said that the number of customers using Zoom Phone reached 3 million during the quarter. Zoom is also focusing more on the enterprise crowd by launching Zoom IQ, which is a call analytics tool for sales departments.

The company’s progress on diversifying its product portfolio and expanding its horizontals should lead to higher growth in the near future. While the company grew the top-line 12% in Q1, it was still the slowest growth period in the company’s history. Furthermore, Microsoft’s competing video communications and collaboration software, Teams, has started emerging as a clear rival in the space. As offices reopen and business fliers return to on-site customer visits, the company’s product could also come under further strain.

Despite these overhangs, the company’s first quarter results rebutted the drastically negative sentiment on the company’s outlook and future viability. The company is also successfully cross-selling its Zoom Chat, Zoom Phone and Zoom IQ to enterprise customers, who need a one-stop solution for monitoring, analyzing and recording their communications with clients. The company’s valuation has also been cut by 80%, making its forward P/E of 26x relatively reasonable compared to peers.

This content is provided for general information purposes only and is not to be taken a investment advice nor as a recommendation for any security, investment strategy or investment account.